Federal Income Tax 2024 – We break down the process of paying federal taxes and provide you with the most up-to-date information to make filing your 2023 and 2024 tax returns as painless as possible. . The IRS said it is opening up its Direct File tax-filing program today, Wednesday, starting at 6 a.m. PT (9 a.m. ET).Today’s sign-up window is part of the IRS for small-scale tests of its Direct File .

Federal Income Tax 2024

Source : www.forbes.comIRS: Here are the new income tax brackets for 2024

Source : www.cnbc.comProjected 2024 Income Tax Brackets CPA Practice Advisor

Source : www.cpapracticeadvisor.com2024 Income Tax Brackets And The New Ideal Income Financial Samurai

Source : www.financialsamurai.comIRS Announces 2024 Tax Brackets, Standard Deductions And Other

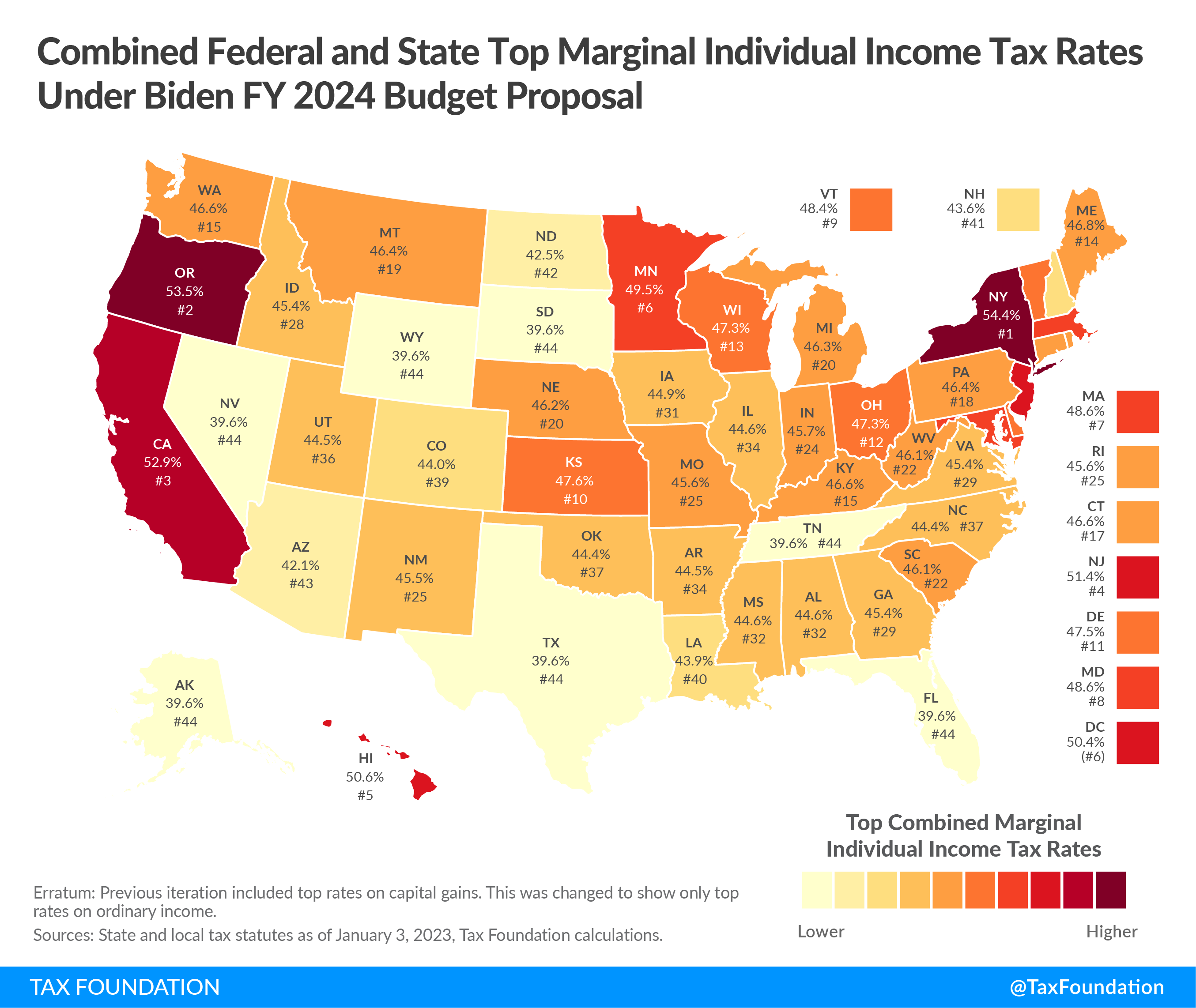

Source : www.forbes.comBiden Budget Taxes Top $4.5 Trillion | Tax Foundation

Source : taxfoundation.orgKick Start Your Tax Planning For 2024

Source : www.benefitandfinancial.comTax brackets 2024| Planning for tax cuts | Fidelity

Source : www.fidelity.comFederal Income Tax Brackets For 2024

Source : thecollegeinvestor.com2024 State Corporate Income Tax Rates & Brackets

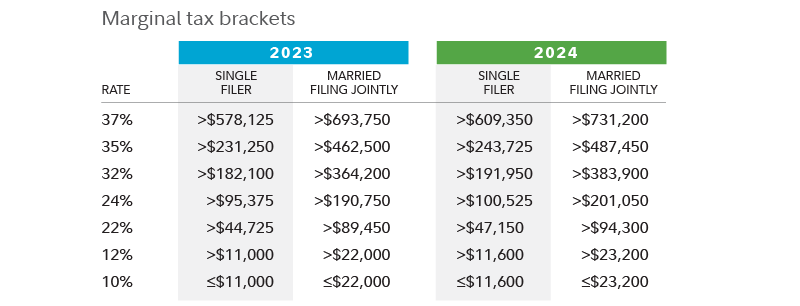

Source : taxfoundation.orgFederal Income Tax 2024 Your First Look At 2024 Tax Rates: Projected Brackets, Standard : For both 2023 and 2024, the seven federal income tax rates are 10%, 12%, 22%, 24%, 32%, 35% and 37%. Below, CNBC Select breaks down the updated tax brackets of 2024 and what you need to know. . A tax credit is the dollar-for-dollar amount of money that taxpayers subtract directly from the income taxes owed. A federal tax credit is granted by the federal government. .

]]>